To better understand how ACA subsidies change with income, see our ACA Premium and Subsidy Calculator. For more detail, you can review our latest tax return (2018.) Considerationsįederal taxes are only one aspect of tax burden - if you live within the US, you are also probably subject to State taxes and maybe get insurance through the ACA Health Exchange (which acts as a tax.) Increasing AGI may impact the ability to take deductions and may eliminate or reduce other subsidies, such as the Saver's credit and Earned Income Tax Credit and Student Aid. To see how these opportunities play out, see how we pay zero taxes on $100k/year income. This tax calculator will estimate tax burden, yes, but by sharing marginal rate info and opportunities for tax-free Roth conversions and capital gain harvests it also is helpful for minimizing tax burden today and in the future. Instead of using unhelpful tools, I built my own.

By trying to cover the weird cases that apply to only a few people, most tax calculators are needlessly complex and time consuming. The US tax code is rather simplistic and straight forward for the vast majority of tax-payers. To think long term, we need to understand our marginal tax rate and options for tax-free income and growth. Long-term thinking is at the heart of any good tax minimization strategy, including our own efforts to Never Pay Taxes Again. Total Tax with FEIE: Total tax minus tax on excluded income. Tax on Foreign Earned Income: Calculated tax burden on the excluded income. Total tax: The sum of tax for both Ordinary and Qualified income.

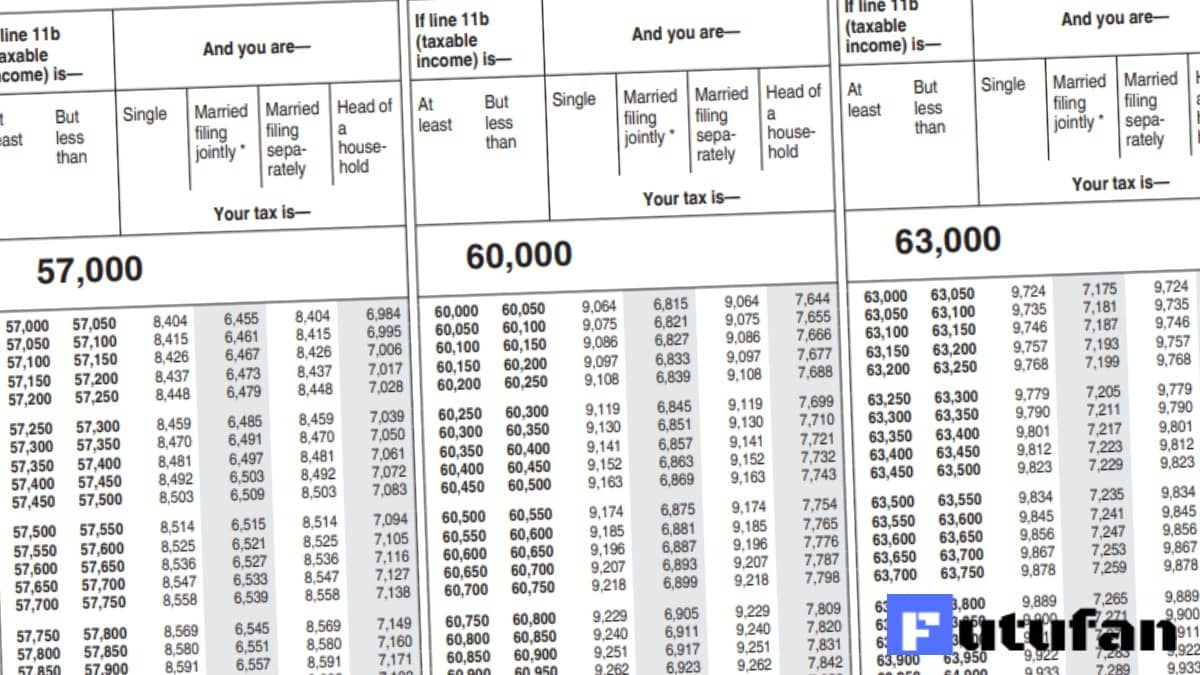

Tax on Qualified Income: Calculated tax burden on qualified income. Tax on Ordinary Income: Calculated tax burden on ordinary income. Taxable Income: AGI minus deductions (Standard or Itemized). Itemized Deductions: The sum of all itemized deductions (if applicable)įoreign Earned Income: The sum of all foreign earned income eligible for the Foreign Earned Income Exclusion (FEIE.) Outputs:Īdjusted Gross Income (AGI): Total income minus adjustments. Qualified Income: Qualified dividends and long-term capital gains.Īdjustments: Top of the line deductions - IRA contributions, student loan interest, 1/2 of self-employment taxes, etc. Ordinary Income: Job & self-employment income, interest, non-qualified dividends, short-term capital gains, taxable retirement income, etc. This decides which standard deduction and tax brackets apply (see details here.) Filing Status: Your tax filing status - Married filing jointly or separately, Single, Head of Household.

0 kommentar(er)

0 kommentar(er)